haven't filed taxes in 5 years

For each year that you failed to file a tax return make sure you have your W-2 or Form 1099. For example if you made less than 13229 in 2020 your.

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Maximize Your Tax Refund.

. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Input 0 or didnt file for your prior-year AGI. I havent filed taxes for 5 years how do I go about getting caught up and what is the best way.

Opry Mills Breakfast Restaurants. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available. Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help.

The deadline for claiming refunds on 2016 tax returns is April 15 2020. CPA Professional Review. I didnt file taxes for probably a total of 6 years Im 26.

Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. If you cant find this paperwork you can request a copy of your income information. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

Then start working your way back to 2014. Some tax software products offer prior-year preparation but youll have to print. In many cases some penalties and interest can be waived or abated.

Registered members of the. Ask Your Own Tax Question. Foreign Bank Account Reporting FBAR.

What do I do if I havent filed taxes in 5 years. I filed last in 2012 so I could get financial aid for school. Ad More 5-Star Reviews Than Any Other Tax Relief Firm.

Answered 1 year ago Author has 778 answers and 1051K answer views Originally Answered. Ad Prevent Tax Liens From Being Imposed On You. Affordable Reliable Services.

What if you Have Never Filed. Generally the IRS is not interested in going father back than six years but they can if they have reason to. In almost every case we see no you do not need to file every year.

However you can still claim your refund for any returns. Restaurants In Matthews Nc That Deliver. What happens if you havent filed taxes in 5 years.

If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as. Ad More 5-Star Reviews Than Any Other Tax Relief Firm. The IRS generally wants to see the last seven years of returns on file.

No Tax Knowledge Needed. I owed that year because the year before I got a small tax-free settlement. Take Avantage of Fresh Start Options Available.

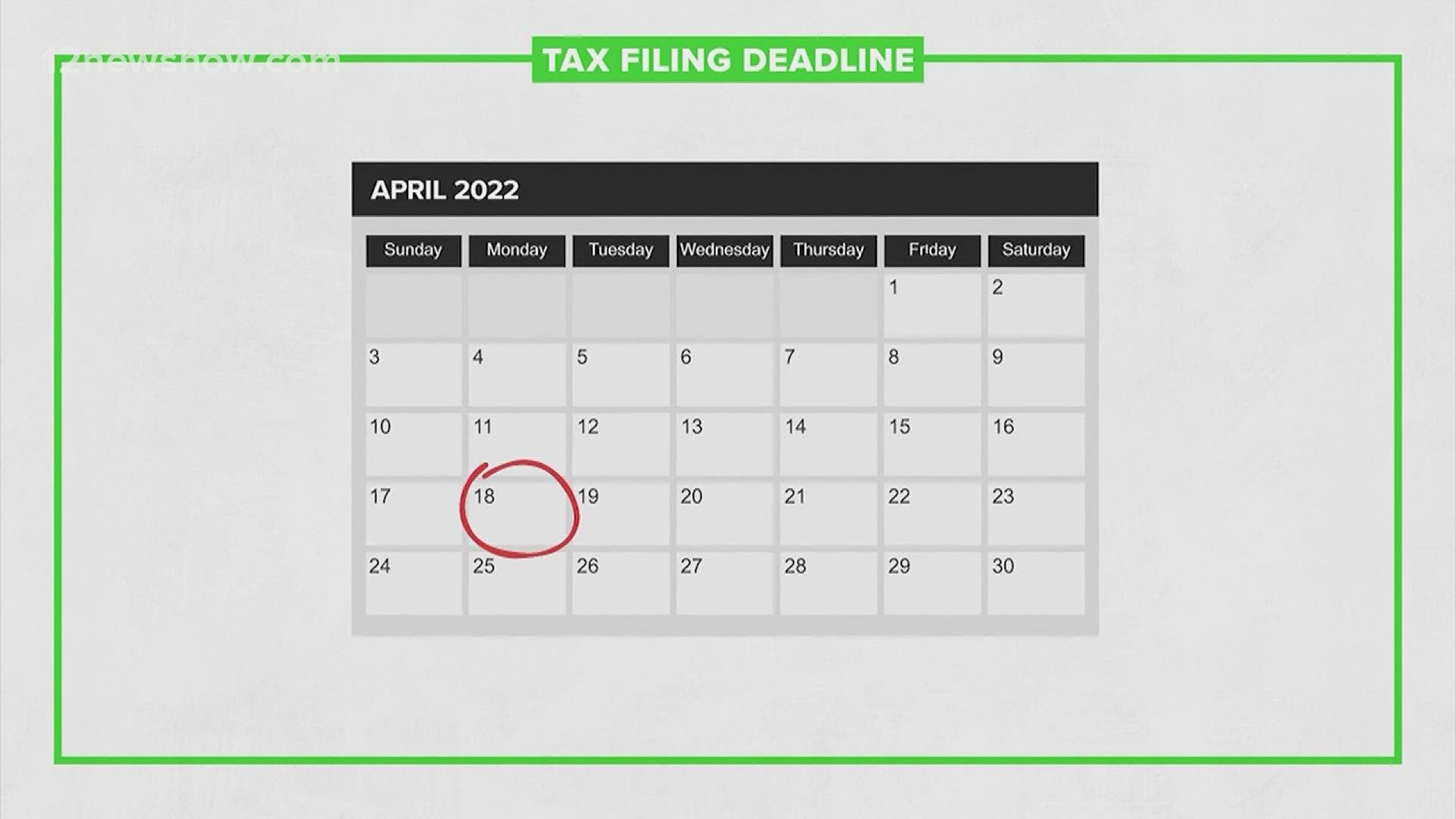

Havent Filed Taxes in 5 Years Its too late to claim your refund for returns due more than three years ago. Tax Relief up to 96 See if You Qualify For Free. Tax not paid in full by the original due date of the return regardless of extensions of time to file may also result in the failure-to-pay penalty unless you have reasonable cause.

The IRS doesnt pay old refunds. A Primer for Expats. Confirm that the IRS is looking for only six years of returns.

Gambling is one of the most ruinous and malignant forces in society. Bring all the documents for each year. Capture Your W-2 In A Snap And File Your Tax Returns With Ease.

February 16 2022 at 526 am. How do I file my taxes if I havent been in 5 years. If the IRS filed for you youll want to.

However you can still claim your. You dont have to file taxes if There are very few circumstances that excuse your obligation to file taxes in Canada. So many lives have been ruined so many have ended in sheer tragedy.

Havent Filed Taxes in 5 Years If You Are Due a Refund Its too late to claim your refund for returns due more than three years ago. Ad We Can Solve Any Tax Problem. Living Abroad and Havent Filed Tax Returns.

Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help. Havent Filed Taxes In 5 Years Will I Still Get A Stimulus Check. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Starting Tomorrow 4 9 14 We Have New Extended Hours To Better Serve Our Customers So If You Haven T Filed Your Tax Filing Deadline Filing Taxes Liberty Tax

In Pakistan The One Person Company Is Also Known As Smc Single Member Company This Company Came To Existence In 2010 Additionally Person Company Spectrum

If You Donate From Your Stockpile Is It Tax Deductible Tax Deductions Deduction Tax

5 Things To Remember For Us Expats Things To Know Us Tax Infographic

What To Do If You Haven T Filed Taxes In Years Bc Tax

12 Simple Money Management Tips You Can Start Today Filing Taxes Work Life Balance Tips Work Life Balance

What To Do If You Re Late Filing Taxes 11alive Com

I Haven T Filed Taxes In 5 Years Youtube

Always Be On The Safe Side Keep Your Eyes Open Money Finance Check And Balance Finance Tips Finance

Don T Forget To Join Us For Tomorrow S Virtual Lunch Learn Seminar For Insurance Professionals Rsvp 228 875 5787 How To Find Out Seminar Free Webinar

2020 Tax Deadline Is Today Here S What You Need To Know If You Haven T Filed Tax Deadline Tax Debt Health Savings Account

What Are The Things Which Are Not Taught In School Its Cliche At This Point To Say That The Most Important Things You Learn In Life You Teaching School Lesson

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only D Online Taxes Income Tax Filing Taxes

Just Letting Yall Know That We Will Have Several Appreciation Events Coming Up For Seniors Volunteers And Employee Appreciation You Know Where Senior Citizen

Get Ahead Of The Tax Filing Game In 2022 Filing Taxes Credit Consolidation Online Taxes

40 Years Ago And Now From 70 To 30 Peak I T Rate Standard Deduction Income Tax Tax Rules

I Haven T Filed Taxes In 5 Years How Do I Start

5 Myths About Filing For A Tax Extension That Are Flat Wrong Tax Extension Tax Help Tax Questions